Unpacking the "One Big Beautiful Bill": Truths, Myths, and What It Means for You

As of July 5, 2025, the "One Big Beautiful Bill Act" (H.R. 1, 119th Congress) has stirred both hope and controversy since its passage on July 1, 2025. Promising sweeping tax reforms, border security enhancements, and healthcare adjustments, this 940-page legislation has sparked intense debate. Tik Tockers and YouTubers offer their breakdowns claiming everything from permanent tax cuts to a mysterious $50 billion rural hospital fund. But how much of this analysis holds up against the official text on Congress.gov? Let’s dive into the facts, debunk the myths, and explore what this bill truly means for your wallet and well-being.

The Core Promises: What’s Legit?

The bill’s cornerstone is the permanent extension of the 2017 Tax Cuts and Jobs Act, a move confirmed by the official text (Title XI, Subtitle A). This keeps your current tax brackets (10% to 37%) intact, avoiding a projected 2-4% hike, and boosts the child tax credit to $2,500 through 2028 (rising to $2,000 after). If you’re a parent or taxpayer, that’s real money staying in your pocket. Additionally, the state and local tax (SALT) deduction jumps from $10,000 to $40,000, a win for high-tax state residents. The phase-out of electric vehicle tax credits, signals a shift away from green incentives.

Healthcare reforms include tightened SNAP and Medicaid eligibility, introducing work requirements for able-bodied adults aged 18-54 (with exemptions for disability or dependents under 7, per Title I, Sec. 10102). This aims to curb fraud.

However, claims about the number of illegal immigrants losing coverage vary. The White House and some congressional sources have cited a figure of 1.4 million, suggesting this number represents undocumented immigrants currently accessing Medicaid who would be removed due to these changes. This figure appears to originate from preliminary Congressional Budget Office (CBO) estimates and White House statements, which argue it protects Medicaid by eliminating ineligible recipients. Yet, fact-checking and policy analyses (e.g., from FactCheck.org and the Center on Budget and Policy Priorities) clarify that undocumented immigrants are not legally eligible for full Medicaid under current law—only emergency services are covered, accounting for less than 1% of Medicaid spending. The 1.4 million figure more accurately reflects individuals losing coverage from state-funded programs (not federal Medicaid) in the 14 states and D.C. that use their own funds to cover undocumented immigrants, as the bill reduces the federal Medicaid match rate (from 90% to 80%) for these states, pressuring them to end such programs.

As of the latest available information, 14 states plus Washington, D.C., provide state-funded health coverage to undocumented immigrants, though the specifics of coverage (e.g., children, adults, or pregnant individuals) vary by state. These states are:

California

Colorado

Connecticut

Illinois

Maine

Massachusetts

Minnesota

New Jersey

New York

Oregon

Rhode Island

Utah

Vermont

Washington

The CBO and other analyses (e.g., KFF, CBPP) estimate broader Medicaid coverage losses—ranging from 7.8 million to 12 million over a decade—due to work requirements, eligibility checks, and funding cuts, but these include legal residents and citizens, not just undocumented immigrants.

The Myths: Where Analysts Stumble

There are a lot of Tik Tokers & YouTubers coming out with their analysis but I’m interested in presenting the facts of the Bill & what it means for my fellow Warriors.

Tax-free Tips: The Truth (expires before January 1, 2029)

Eligible individuals can deduct up to $25,000 annually, with the benefit phasing out for those with modified adjusted gross income (MAGI) exceeding $150,000 (or $300,000 for joint filers). The deduction applies to cash tips (including those paid by check or credit card) in traditionally tipped occupations, excluding high-income professions like accounting, law, or financial services. However, Social Security, Medicare (FICA), and state/local taxes still apply, and employers must continue withholding these.

Tax-free Overtime: The Truth (expires before January 1, 2029)

The deduction is capped at $12,500 per year for single filers or $25,000 for joint filers, also phasing out above $150,000 MAGI (or $300,000 joint). It covers overtime pay under the Fair Labor Standards Act, reported separately on W-2s, but excludes highly compensated employees. Like tips, FICA and state/local taxes remain applicable, with employers required to report and withhold accordingly.

Social Security Tax Relief (expires in 2028)

The exemption allows individuals to deduct the first $6,000 of their Social Security benefits from their adjusted gross income (AGI) when filing federal income taxes. For married couples filing jointly, this deduction doubles to $12,000. The benefit phases out for those with modified AGI exceeding $75,000 (single filers) or $150,000 (joint filers), reducing by $1 for every $2 of income above these thresholds until it is fully eliminated at approximately $87,000 (single) or $174,000 (joint). This structure targets relief toward modest-income retirees while limiting benefits for higher earners.

Key details:

The exemption applies only to the taxable portion of Social Security benefits, which depends on combined income (AGI plus nontaxable interest plus half of Social Security benefits). Currently, up to 85% of benefits can be taxable for those above certain income thresholds ($25,000 single, $32,000 joint), so the $6,000/$12,000 deduction directly reduces this taxable amount.

It does not affect the 6.2% Social Security payroll tax paid by workers and employers or the 1.45% Medicare tax, which remain unchanged.

The $10,000 Car Loan Interest Deduction (expires in tax year 2028)

This above-the-line deduction allows taxpayers to reduce their taxable income by up to $10,000 annually for interest paid on qualifying passenger vehicle loans, aligning with President Trump's campaign promise to support American manufacturing and consumers.

Key Details:

Eligible Vehicles: The deduction applies only to new vehicles (not used cars) with final assembly in the United States, including cars, minivans, vans, sport utility vehicles, pickup trucks, or motorcycles with a gross vehicle weight rating under 14,000 pounds. Exclusions cover all-terrain vehicles, trailers, campers, fleet sales, commercial vehicles not used personally, and vehicles with salvage titles.

Loan Requirements: The loan must be the first on the vehicle, secured after December 31, 2024, and used for personal purposes. Taxpayers must include the vehicle identification number (VIN) on their tax return to claim the deduction.

Income Limits: The full deduction phases out for taxpayers with modified adjusted gross income (MAGI) exceeding $100,000 (or $200,000 for joint filers), reducing by $200 for every $1,000 (or fraction thereof) above these thresholds, dropping to zero around $115,000 (single) or $230,000 (joint).

Practical Impact: The average new car loan in 2025 is about $43,000, generating roughly $3,000 in first-year interest at current rates (e.g., 8.64% over 5 years), yielding a tax benefit of about $500 for the average buyer in year one, per economic analyses. To maximize the $10,000 deduction, a loan of approximately $110,000-$112,000 is needed, applicable to less than 1% of buyers (e.g., luxury brands like Porsche or Rolls-Royce), according to Cox Automotive data.

Analysis and Limitations:

The deduction is designed to incentivize purchases of U.S.-assembled vehicles, but its benefit is skewed toward higher-income buyers of expensive cars, as most Americans finance loans far below the threshold. The temporary nature (expiring 2028) and exclusion of used cars—purchased by 61% of low- to middle-income households—limit its reach, potentially favoring wealthier taxpayers in higher tax brackets. Critics argue it adds complexity and administrative burden (e.g., VIN reporting), while supporters see it as a boost for domestic auto jobs amid Trump’s tariff policies. The CBO estimates a $31 billion cost over four years, raising questions about its fiscal impact given the narrow beneficiary pool.

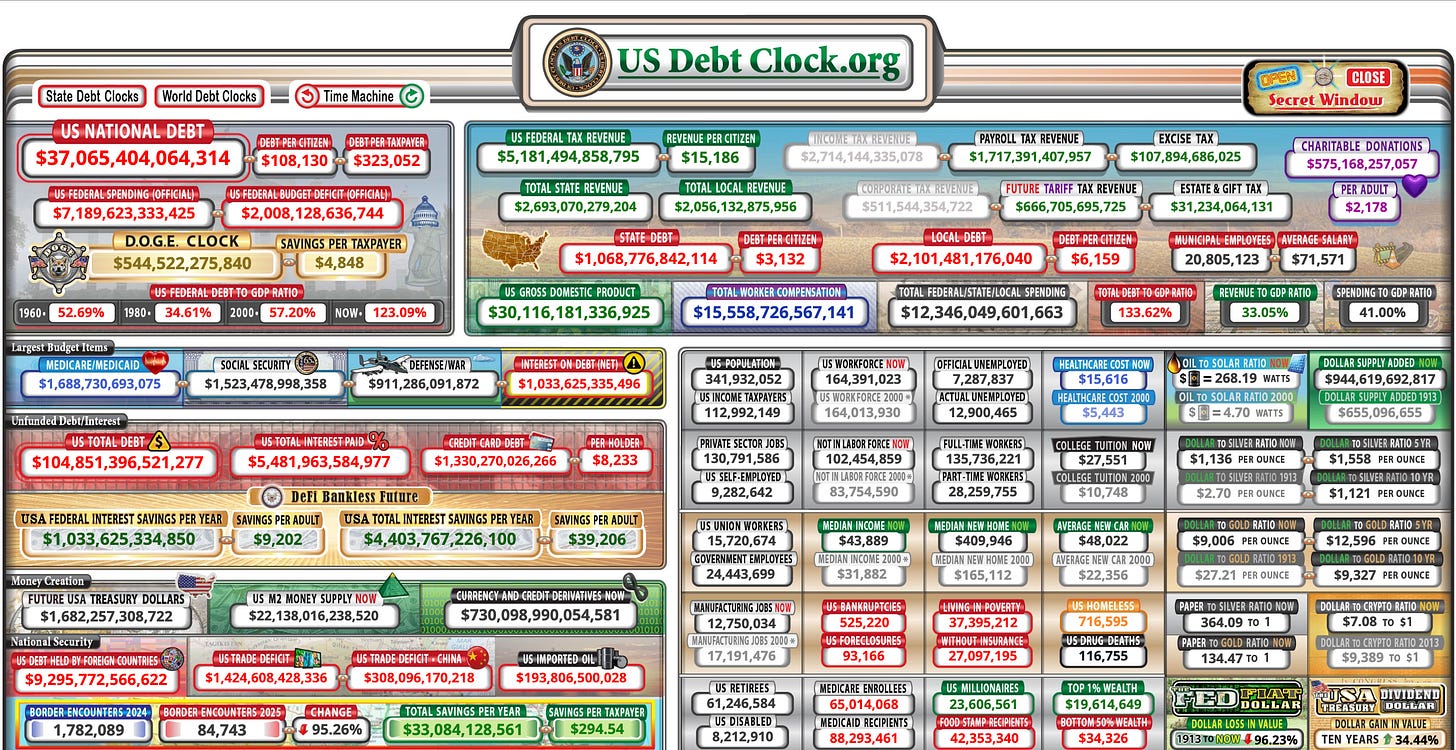

The Debt Ceiling

The Bill increases the debt ceiling by $5 trillion. This adjustment, detailed in Section 113001 of the Senate text, raises the previous limit to accommodate additional borrowing to cover existing obligations, with the new ceiling taking effect immediately upon enactment. This figure reflects the final version passed by the Senate (51-50) on July 1, 2025, and the House (218-214) on July 3, 2025, surpassing the initial $4 trillion proposal in the House's February 2025 budget resolution (H. Con. Res. 14). The increase has sparked debate, with some arguing it avoids a default amid a projected $3.3 trillion deficit rise over a decade, while others, including fiscal conservatives, criticize it as excessive given the national debt nearing $36 trillion.

Border Protection (available until September 30, 2029)

The Bill includes a budget for border wall construction. The official text, as detailed in Section 90001 of Title IX, appropriates $46.55 billion for fiscal year 2025, available until September 30, 2029, to the Commissioner of U.S. Customs and Border Protection for constructing, installing, or improving primary, waterborne, and secondary barriers along the southern and northern U.S. borders. This funding covers physical barriers, access roads, and related infrastructure such as cameras, lights, and sensors. The White House and congressional statements, including those from House Homeland Security Committee Chairman Mark Green, specify plans for 701 miles of primary wall, 900 miles of river barriers, 629 miles of secondary barriers, and 141 miles of vehicle and pedestrian barriers, aligning with the $46.5 billion figure cited in various reports.

Defense Spending (available until September 30, 2029)

The Bill includes a significant defense package, with funding estimates varying across sources but commonly cited as $150 billion to $157 billion for fiscal year 2025, available until September 30, 2029. Based on the official text and supporting analyses, the defense package—primarily under Title II and Section 20001—allocates additional funds to the Secretary of Defense beyond existing appropriations, though the exact total of $157 billion appears to be an aggregate figure from combined estimates rather than a single line-item appropriation. Here’s a breakdown of the key components:

Shipbuilding and Naval Enhancement: Approximately $29 billion is directed toward naval capabilities, including $4.6 billion for a second Virginia-class submarine in FY 2026, $5.4 billion for two Guided Missile Destroyer (DDG) ships, $492 million for next-generation shipbuilding techniques, $450 million for U.S. manufacturing of wire and machining capacity, $500 million for additional dry-dock capability, and $2.1 billion for medium unmanned surface vessels. Additional funds support turbine generators, steel plate production, and workforce development, totaling around $4.7 billion for industrial base expansion.

Aircraft and Air Force Modernization: Roughly $5.8 billion is allocated for air assets, with $3.15 billion to increase F-15EX production, $361 million to prevent F-22 retirement, $127 million for F-15E preservation, $440 million for C-130J production, $474 million for EA-37B, $678 million for the Collaborative Combat Aircraft, $750 million for the FA/XX aircraft, and $600 million for Air Force long-range strike aircraft development.

Munitions and Weapon Systems: Approximately $2.7 billion supports munitions, including $2 billion for Defense Innovation Unit scaling of commercial technology and $700 million for advanced manufacturing techniques, though broader estimates from posts on X and web sources suggest up to $25 billion for munitions production capacity and supply chain resilience.

Missile Defense (Golden Dome): $25 billion is designated for the "Golden Dome" missile defense system, a layered defense initiative including space-based components, aligning with Trump’s vision for homeland protection against ballistic threats.

Quality of Life and Personnel Support: About $9 billion enhances servicemember welfare, including $2 billion for the Defense Health Program, $2.9 billion for Basic Allowance for Housing, $590 million for Temporary Lodging Expense Allowance (up to 21 days), $100 million for child care fee assistance, and $50 million for bonuses and special pays.

Infrastructure and Innovation: Additional funds include $1 billion for military unaccompanied housing sustainment, $400 million for audit improvements, $230 million for Marine Corps Barracks 2030, and $1.5 billion for small unmanned surface vessel production.

Border Security and Other: $1 billion is allocated for Defense Department border security operations, complementing the $46.5 billion for CBP border wall construction.

The $157 billion figure likely aggregates the $150 billion base defense boost (as per Senate and House passages) with overlapping or adjusted funds from other sections, such as the $1 billion for border security or unlisted munitions increases. However, the official text lists specific appropriations totaling around $22.5 billion under Title II, suggesting the higher estimate includes discretionary adjustments or prior-year carryovers. Discrepancies arise from reconciliation debates—e.g., House vs. Senate versions—and lack of a unified line-item report, with the Pentagon required to submit a spending plan within 45-60 days (Section 20014). Critics on X and web sources question the package’s fiscal justification given the $3.3 trillion deficit projection, while supporters highlight its role in countering China’s naval growth. The true scope may clarify as implementation data emerges.

Will Tariffs Reduce the Deficit?

The bill’s tax provisions are projected to reduce federal revenue by approximately $5 trillion over 2025-2034 on a conventional basis, with dynamic scoring (factoring in a 1.2% GDP increase) lowering this to about $4 trillion, per Tax Foundation analyses. The Congressional Budget Office (CBO) estimates a net deficit increase of $3.3 trillion to $3.8 trillion over the same period, after accounting for $1.2 trillion to $1.6 trillion in spending cuts, including Medicaid and SNAP reductions.

Tariffs, imposed separately by the Trump administration, are not part of the bill but are touted by the White House as a fiscal offset. Estimates suggest tariffs could raise $2.1 trillion to $2.8 trillion in revenue over a decade, based on analyses of current rates covering over 70% of U.S. imports. The administration claims this, combined with economic growth and spending cuts, could reduce the deficit by $1.4 trillion to $6.6 trillion, asserting the CBO underestimates these effects. However, the CBO and Tax Foundation models indicate tariffs may reduce long-run GDP by 0.6% due to higher consumer prices and potential retaliation, offsetting some economic growth from tax cuts and thus limiting revenue gains.

Critically, the narrative hinges on assumptions. The White House argues the CBO’s baseline, treating current tax rates as expiring, misrepresents the bill’s impact, claiming it reduces deficits against a “current policy” baseline. Yet, this “magic math” is disputed by nonpartisan groups like the Committee for a Responsible Federal Budget, which project a $3 trillion+ deficit rise, with interest costs potentially hitting $2 trillion annually by 2034. Posts on X reflect a split sentiment—some users assert tariffs fully offset the deficit, citing $2.8 trillion projections, while others argue tariffs, averaging $1,200 per household annually, act as a tax increase that slows growth, failing to close the gap.

The evidence suggests tariffs may offset a portion—potentially 50-70%—of the deficit increase in static terms, but dynamic effects (growth vs. trade disruption) remain uncertain. Without tariffs integrated into the bill’s text, their revenue is speculative and subject to trade policy shifts. Given the $2 trillion+ annual deficit baseline and the bill’s $5 trillion revenue loss, full offset seems unlikely without significant unmodeled growth or additional cuts, making the claim dubious. Further data from tariff collections, negotiations, and economic performance will be needed for further analysis.

The Real Impact: Your Money and Security

Despite the inaccuracies, H.R. 1’s economic footprint is significant. The $1.6 trillion in spending cuts over 10 years (per CBO estimates) targets non-discretionary programs like Medicaid, aiming to offset a $3.6 trillion deficit increase from tax cuts. For you, this means lower taxes now but potential service cuts later—especially if you rely on Medicaid or live in a state with lax eligibility oversight, where costs may shift locally. Funds from tariffs may

Border security gets a boost with new CBP fees (e.g., $5 for visa updates, Sec. 100015), but the grand wall vision remains underfunded beyond existing allocations. Defense spending is enhanced, though specifics are vague, reflecting a broader military focus amid global tensions (e.g., Iran-Israel conflict updates on X).

Why It Matters: Preparing for the Ripple Effects

This bill’s passage coincides with a volatile 2025, where oil price surges (Brent at $75 post-Iran strikes) and stock market jitters (VIX at 20.82) amplify economic uncertainty. The call to stockpile essentials like fuel and food resonates, given potential supply chain disruptions. In addition, focus on verified tax benefits—maximize your SALT deduction or child credit—and monitor healthcare access changes.

The Verdict: Trust but Verify

As my fellow Warriors navigate this new legislative landscape, cross-check with Congress.gov and consult a tax accountant. The “Big Beautiful Bill” is here, but its beauty lies in the details—and those details demand scrutiny, especially if you rely on any government programs.

Until next time my fellow Warriors, Stay Vigilant, Stay Informed, Ever Forward!