Tariffs Are Just the Tip of the Iceberg: The Real Forces Driving U.S. Economic Uncertainty

A State of the Union Report

The term “uncertainty” has been making the rounds in economic circles and across the internet, frequently cited as the reason behind the recent volatility in the U.S. stock market, gold prices, and the overall economy. But are the on-again, off-again tariffs and fluctuating Trump administration policies truly responsible for this instability, or is there more beneath the surface?

Let’s examine some key United States market indicators:

The Federal Reserve & Interest Rates

The Federal Reserve has kept interest rates the same after it’s most recent meeting at 4.25-4.5%

Expectation remains for two rate cuts before the end of 2025 (June & possibly December)

The Federal Reserve will drastically reduce its quantitative tightening by only allowing $5 billion in U.S. treasuries to roll over instead of $25 billion. More maturing debt will be rolled into new debt thereby reducing liquidity. Mortgage backed securities are excluded & will continue to run off.

When addressing the current inflation, Chair Powell deflected the blame from the Federal Reserve’s monetary policy to the tariffs which haven’t really been in play yet.

Adopting a wait & see approach regarding inflation & consumer prices will mean it will be too late to address it by raising interest rates as those are lagging indicators.

Gold Prices & Market Signals -

Gold has broken all time highs at $3,053.03 per ounce on March 19, 2025. Former Fed chair Alan Greenspan referred to gold as an economic indicator of monetary policy. The higher gold went was an indicator of the Fed’s monetary policy being too lose (at that time he was using $400 & $300/ounce as standards).

Since the year 2000, the S&P is down 60% if it was priced in gold. Meaning the gains seen in the stock market are largely due to inflation (destruction in the value of money) & not a genuine increase in the value of the companies that comprise the S&P index.

More central banks are investing in gold bullion to sit in a vault & are foregoing the 4-4.5% return in U.S. treasuries.

The dollar is weakening & one of the main reasons the CPI retraced was the strength of the dollar. The dollar moving up brought commodity prices down. Now it is doing just the opposite.

Inflation Concerns & Monetary Policy

Inflation is not just an expansion of the money supply, it is the expansion of credit. The more credit there is in the economy, the more upward pressure there is on prices.

Inflation is going to increase this year as Core PCE forecasts were revised from 2.5% made in December to 2.8% as of the March 19, 2025 Fed Summary of Economic Projections.

If inflation is moving further away from the two percent target, it wouldn’t make sense for the Fed to telegraph two rate cuts this year which would undoubtedly make inflation worse. There should be no rate cuts at all.

The projections for real GDP were also downwardly revised from 2.1 in December to 1.7% on March 19th.

Higher inflation plus lower growth (increases budget deficits & puts downward pressure on the dollar) equals stagflation.

The five-year inflation expectation rose to 3.9% which is the highest it has been in over 30 years. Meaning consumers believe inflation is going to average almost 4% per year for the next five years. Yet the Federal Reserve fails to acknowledge the consumer’s belief is double the Fed’s target rate of inflation.

It’s a shame they stopped updating John Williams’ Shadow Stats. The site would often reveal that inflation was double the government stated inflation based on the old ways of calculating the CPI.

Tariffs -

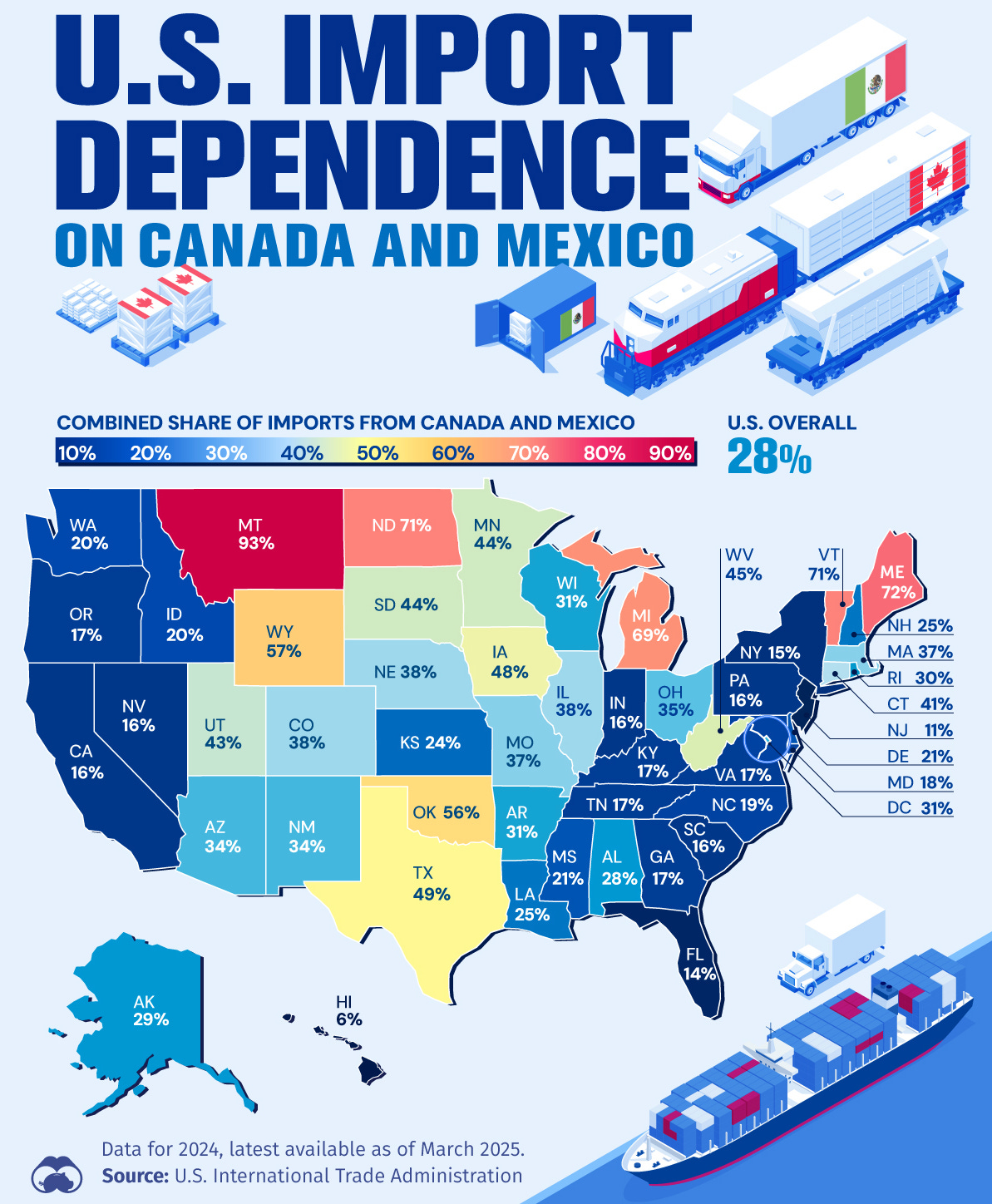

The tariffs imposed on Canada & Mexico will not effect all states equally as depicted by the Visual Capitalist:

Those states with the lowest imports from Canada & Mexico such as New Jersey, Florida, & New York will not be impacted by the tariffs as much as Montana, North Dakota, & Wyoming. This map serves as a handy guide to how dependent each state is on other countries to thrive & may be useful for Plan B domestic planning scenarios.

Consumer Sentiment & Retail Spending -

The University of Michigan’s mid-March survey of consumer sentiment showed household’s outlook sank 11 points to 57.9, a drop down from February’s rating of 64.7. The reading shrank for three consecutive months to the lowest rating since November 2022 & was far below the 63.2 expected by Wall Street Journal economists. Consumer sentiment is 27% gloomier than is was a year ago. Consumer sentiment guides spending habits. Consumer spending accounts for approximately 70% of the U.S. economy.

Shoppers are spending less at convenience stores as sales volumes dropped 4.3% in the year ending 11 February as prices for discretionary items such as rice cakes, dips, jerky, nuts, tobacco, & other convenience items rose steadily. Refrigerated products sales volume was down 7% & chocolate candy was down 6%.

Retail Sales Reports from February 2025 revealed the following:

Retail faced headwinds in February 2025: February retail sales declined 0.9%, and in-store visits dropped 4.7% year-over-year. Core retail, which excludes food service, gas stations, and autos, dipped 0.2%. While a shorter month (compared to last year’s leap year) contributed to the decline, consumer sentiment also softened due to rising economic uncertainty and weather disruptions.

Grocery and home furnishings showed resilience: Grocery foot traffic declined by 1.95%, but essential spending remained relatively stable. Home furnishings saw a modest 1.5% sales increase, benefiting from prior housing market strength. Meanwhile, home improvement retail struggled, with visits down 7.2%, as consumers delayed large-scale projects.

Discretionary spending slowed, except for entertainment: Apparel sales fell 3.2% as seasonal demand weakened and post-holiday promotions tapered off. Electronics stores saw a sharper 9.2% drop, reflecting consumer hesitancy toward big-ticket purchases. However, theaters and music venues saw an 8.03% increase in visits, indicating that experiences remained a priority despite shifting discretionary spending.

Fitness and dining trends divided: Gym visits declined 5.96%, but fitness-related retail sales grew 2.44%, signaling continued demand for at-home wellness solutions. Restaurants, however, struggled with a 7.35% drop in visits as consumers cut back on dining out. - Colliers

Treasury Secretary Scott Bessent stated the U.S. economy needs to “detox” from its dependence on federal spending.

Russell 2000 - The Index Closest to the People

The Russell 2000 index tracks small & mid-size companies which are more sensitive to fluctuations in the economy unlike the S&P 500 which is made up of the ‘Mag 7’ mega conglomerates & meme stocks. The Russell 2000 index is showing a clear warning of a recession as the index has fallen 16% since its peak last November. The Russell is poised to be the first U.S. index to fall into bear market territory (more than 20% below most recent high).

Confidence among small business owners has fallen for three consecutive months according to the National Federation of Independent Business. Uncertainty about the future can cause small businesses to cut hiring, forego expansion, & have long-term effects on growth.

The Jobs Market -

In a February survey by the Federal Reserve Bank of New York, respondents saw a 39.4% chance that joblessness will increase in the next 12 months, the highest number since 2023. DOGE’s cleaning out of excess government positions & other companies planned to cut 172,017 workers in the next months (Challenger, Gray, & Christmas report) could mean some rough times in the days ahead. Some job cuts include:

50% of the Department of Education workforce

10,000 Positions at the USPS through voluntary early retirement

2,000 jobs from Johns Hopkins University due to USAID fund cutting (They held the COVID pandemic simulation)

14,000 managerial positions at Amazon (globally)

Major Stores Going Out of Business

These major businesses are closing their doors:

TD Bank - 38 branches in 11 states

Forever 21 - filed for bankruptcy for the second time & will close all U.S. stores

Dollar General - 96 stores & 45 PopShelf locations

Fossil Group - 50 locations

Denny’s - 38 more restaurants than original 150 announced in October of 2024

Even McDonald’s Traffic is Struggling

In the fast-food chain’s fourth-quarter earnings report for 2024, it revealed that while its global comparable sales increased by 0.4% year-over-year during the quarter, its U.S. comparable sales shrunk by 1.4%. This contributed to McDonald’s facing flat consolidated revenues during the fourth quarter.

A survey from LendingTree in May last year even revealed that roughly 78% of consumers view fast-food as a luxury. Also, 62% of Americans said they eat less fast-food due to high prices, and 56% said they choose to make food at home when they want an easy and cheap meal.

Kempczinski said during the call that the amount of low-income consumers visiting the fast-food chain’s U.S. restaurants was “still down double digits” during the fourth quarter. - The Street

Walmart Falls Short

A Thursday, February 19th investor call forecasted sales and profit for the current year below Wall Street estimates, citing the need for caution in navigating an uncertain geopolitical landscape. Walmart shares, which had risen about 72% in 2024 and hit a record high last week, were down 6% (to $97.21) on the news. Although the stock is listed as $85.98 it’s still higher than it’s 52-week low at $58.56. According to Reuters:

U.S. Debt & Interest Challenges -

For the first 5 months of the fiscal year, the U.S. budget deficit reached $1.15 trillion, 38% more than during the same span during the previous fiscal year. Net interest payments on the debt were $396 billion for the first five months of the fiscal year and $74 billion in February alone. Interest payments are the now the second highest budget expense behind medicare & the military industrial complex is the third highest.

Nearly a third of the debt matures in the next two years and will need to be refinanced at higher interest rates.

The newly approved $4.5 trillion in tax cuts over the next 10 years will add a net $2.5 - $3.3 trillion to the national debt over the next decade.

To deliver $2.5 - $3.3 trillion in new tax revenue over the next 10 years would require massive amounts of new investments & new workers in productive sectors (not service sectors).

Although the newly added DOGE savings clock would have one believe the American tax payer has saved approximately $235 billion, many of the cost cutting measures are being appealed in court or reversed by judges entirely.

What Does This All Mean?

My fellow Warriors, we may have hit the point where the government & the Federal Reserve cannot kick the can down the road any further. The COVID-stimulus highs have long been over. The stimmy checks are a distant memory. The inflation must come home to roost at some point. Look at the personal savings rate:

The average American’s financial position is not thriving.

Why hasn’t President Trump put an end to the war in Ukraine like he said he would? Why has President Trump allowed Israel to reengage Gaza with bombings? The United States needs to keep the monetary spigots to the military industrial complex flowing. Wars are distractions & require money, missiles, & manpower (read War is a Racket by Maj. Smedley D. Butler).

Today, the manpower is the Ukranian & IDF soldier, tomorrow it may be your son or daughter. The Trump & Netanyahu governments are instigating & itching for a wider war with Iran. China is also on the horizon.

Small “wins” like DODGE cuts, tariffs, the Panama Canal, and the potential acquisition of Greenland serve more as distractions from the deeper issues plaguing the domestic economy. While there is some truth to the idea that becoming a more self-sustaining, independent nation will be a painful process—especially after decades of outsourcing production—the added strain of war will only intensify the hardship, pushing the country further into recession.

The buzzword may be ‘uncertainty’ but the domestic economy & geopolitical events are certain. We must be prepared for tough times ahead. There is no better time than now when things are still available with a few clicks of a button & Prime shipping is still ‘a thing’ to stock up on life’s essentials. If you need ideas, here’s my Ultimate Preparedness Checklist:

Until next time my fellow Warriors, stay informed, stay vigilant, Ever Forward!