Iran-Israel Conflict: Rising Oil Prices, Stock Market Volatility, and Supply Chain Disruptions Threaten U.S. Economy

Image Credit: Dawn.com

As tensions escalate between Iran and Israel, with Israeli strikes targeting critical oil and gas facilities like the South Pars Gas Field and Fajr Jam Refinery, the U.S. economy faces a perfect storm of financial instability. Surging oil prices, nearing $75 per barrel with potential to exceed $100, threaten to spike gas costs, fuel inflation, and disrupt supply chains for groceries, electronics, and household goods. Coupled with heightened stock market volatility—evidenced by a VIX spike to 20.82—and looming security risks, including potential cyberattacks and U.S. military entanglement, Americans are on edge. Let’s explore the economic fallout, security threats, and practical steps to prepare for the disruptions ahead.

Source: Marine Vessel Traffic Live View - Sunday, 15 June 2025

Financial and Economical Stance:

Oil Prices and Inflation:

The most immediate and significant impact is on global oil prices. Iran is a major oil producer, and any disruption to its supply or to key shipping routes like the Strait of Hormuz (through which about 20% of the world's global oil output travels) can cause prices to surge.

Impacted in Iran thus far: confirmed targets include the South Pars Gas Field, specifically the Phase 14 Refinery, and the Fajr Jam Natural Gas Refinery, both in Bushehr Province. Additionally, the Shahran oil depot near Tehran and a fuel tank in Tehran have been hit, with fires reported. These incidents mark the first known attacks on Iran's energy infrastructure

Higher oil prices translate to higher gas prices for American consumers and increased costs for businesses, as transportation and manufacturing rely heavily on energy. This can intensify inflationary pressures, potentially reversing the recent trend of cooling consumer prices in the US.

Analysts suggest that sustained gains in energy prices could force the Federal Reserve to keep interest rates higher for longer, impacting borrowing costs for both businesses and consumers.

Stock Market Volatility:

Geopolitical instability typically leads to increased volatility in global financial markets. While past regional conflicts have shown that market downturns are often short-lived, an escalation could trigger more significant corrections, especially in the short term.

The S&P 500, Dow Jones Industrial Average, and Nasdaq have already seen dips in response to recent escalations. Investors may adopt a "wait-and-see" approach, and there could be a flight to perceived safer investments like gold and the dollar.

Pre-market indicators and analyst reactions point to a risk-off mood, with expectations of a sharp opening decline when markets reopen. Oil prices surged over 7% last week, with Brent crude nearing $75 per barrel, reflecting supply disruption fears, while safe-haven assets like gold have risen to around $3,425 per ounce. The Cboe Volatility Index (VIX) closed at 20.82 on Friday, its highest in three weeks, signaling increased investor anxiety. Posts on X also indicate traders bracing for further escalation, though these remain speculative. The full impact will depend on weekend developments, including potential U.S. involvement or Strait of Hormuz disruptions, which could amplify volatility if confirmed.

Supply Chain Disruptions:

Beyond oil, increased tensions in the Middle East, particularly in vital maritime trade routes like the Red Sea and the Strait of Hormuz, can lead to higher shipping costs and broader supply chain disruptions. This affects the cost and availability of various consumer goods.

Companies may face challenges in getting goods from overseas, and these increased costs could be passed on to consumers.

Groceries: Elevated transportation and packaging costs (due to oil price hikes) could raise prices for perishable and packaged foods, with logistics and materials comprising 15-25% and 8-15% of FMCG costs, respectively.

Household Energy Bills: Increased natural gas and oil prices may drive up heating and electricity costs over time.

Packaged Goods: Products reliant on plastic or aluminum packaging (e.g., beverages, snacks) could see price increases as manufacturing and material costs rise.

Consumer Electronics: Potential shipping reroutes and higher logistics costs may affect prices for imported devices.

Broader Economic Growth:

A wider conflict could increase overall economic uncertainty, harming efforts to reduce inflation and potentially slowing global GDP growth. Consumers may cut non-essential spending, and businesses might postpone investment decisions.

In a severe scenario involving a blockade of critical waterways, global GDP could see significant shrinkage, with the US potentially experiencing a notable decline.

Photo Credit: ABC News - 2020 Iran Bombing on U.S. Al Asad Air Base in Iraq

Threats to U.S. Security:

The greatest threats to U.S. security include:

Retaliatory Attacks on U.S. Bases: Iran has threatened to target U.S. military installations in the Middle East, such as those in Iraq and Gulf states, if the U.S. supports Israel or strikes Iranian facilities. This could involve ballistic missiles or drones, potentially overwhelming regional defenses.

Escalation and Regional Instability: Israeli strikes on Iranian nuclear and military sites, including the killing of top commanders, risk drawing the U.S. into a broader conflict. Iran’s proxies (e.g., Houthis, Hezbollah remnants) could target U.S. interests, while a disrupted Strait of Hormuz (20% of global oil) could spike energy prices and destabilize allies.

Terrorism: Damaged Iranian proxies like Hezbollah may shift to global terrorist operations against U.S. personnel, leveraging their international networks.

Nuclear Proliferation Risk vs. Samson Option: Israeli attacks may push Iran to accelerate its nuclear program, potentially leading to a regional arms race or a nuclear-armed Iran, complicating U.S. security strategy. If Israel becomes overwhelmed, it may exercise the Samson Option i.e. launch a massive nuclear retaliation if faced with existential threats, such as the annihilation of the state by a coalition of adversaries. Estimates suggest Israel has 80-400 warheads, deliverable by aircraft, missiles, or submarines.

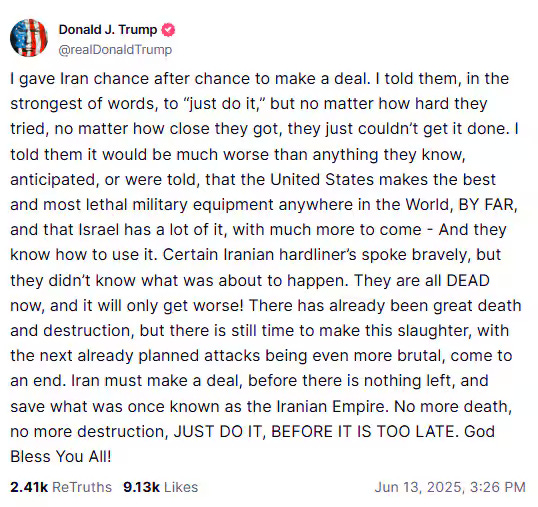

The U.S. has signaled non-involvement in Israel’s recent strikes via Marco Rubio but President Trump involved the United States via Israel & threatened Iran:

Americas close alliance with Israel and a regional troop presence make further entanglement likely if Iran retaliates broadly. Diplomatic efforts to de-escalate were underway prior to the initial wave of attacks, but their resumption in the near future seems highly unlikely, given the United States' threats and the eroded trust with Iran.

How to Get Ahead of Supply Chain & Cyber Disruptions:

I write these articles to empower my fellow Warriors with actionable insights into navigating this conflict's impact. While understanding its effects is valuable, passively absorbing the information without taking steps forward will not serve you well. Here are some action steps:

Fuel: Store extra gasoline (safely, in approved containers) and keep vehicles at least half full, as oil price spikes (Brent crude nearing $75, with potential to exceed $100 if the Strait of Hormuz is affected) could lead to shortages or higher costs. It might also be time to get that oil change you’ve been putting off.

Food: Stockpile non-perishable items (canned goods, rice, pasta, dried beans) for at least two weeks, plus a month’s supply if feasible. Rising transportation costs may increase grocery prices, especially for perishable goods.

Water: Keep 1-2 gallons per person per day for at least two weeks, plus water purification tablets or filters, anticipating potential supply chain delays or energy-related water treatment issues.

Medications: Secure a 30-90 day supply of prescription drugs and over-the-counter essentials (e.g., pain relievers, cold medicine), as global unrest could disrupt pharmaceutical imports. Get an emergency antibiotics kit for you & everyone in your household.

Cash: Have a small reserve of cash (e.g., $200-$500) for emergencies, as power outages or cyberattacks could disrupt digital payments.

Household Supplies: Purchase extra batteries, flashlights, first-aid kits, and hygiene products (soap, toothpaste), which could face shortages if logistics are strained.

Energy Alternatives: Invest in portable solar chargers, propane, or a generator with fuel, given potential energy price hikes or grid vulnerabilities from cyberattacks.

Basic Tools: Stock up on multi-tools, duct tape, and manual can openers for self-sufficiency during potential infrastructure disruptions.

Prioritize items based on your local threat matrix (e.g., urban vs. rural risks) and avoid panic buying. Focus on gradual accumulation to ensure availability, as early action can mitigate the impact of escalating tensions, particularly if the conflict affects global oil supplies or triggers U.S. involvement. Which it likely will. The Majority of our politicians haven’t met a war they didn’t like.

Until next time my fellow Warriors, Stay Informed, Stay Vigilant, Ever Forward!